Form 5472 can be considered a guide for the IRS to understand the global transactions of domestic and foreign related parties, and the penalty for failing to file Form 5472 on time is up to $25,000.

Form 5472 can be considered a guide for the IRS to understand the global transactions of domestic and foreign related parties, and the penalty for failing to file Form 5472 on time is up to $25,000.

Simply put, sales tax compliance is just that - preparing and filing a sales tax return. We have broken down sales tax compliance into 7 steps.

Learn more about taxpayer nexus, constitutional nexus requirements, physical presence standard, and much more.

A resale certificate is a signed document indicating that the purchaser intends to resell the goods and is usually provided by the retailer to the wholesaler.

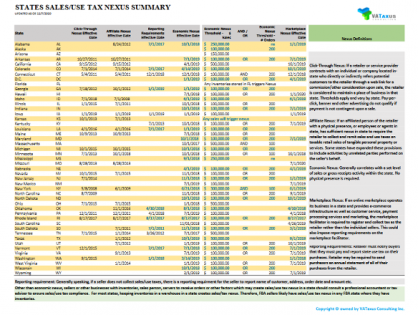

Take a look at our nexus definition summary, feel free to download for your own review.

Use tax is defined as a tax on the storage, use or consumption of taxable goods or services on which no sales tax has been paid. Learn more about difference between Sales Tax and Use Tax.