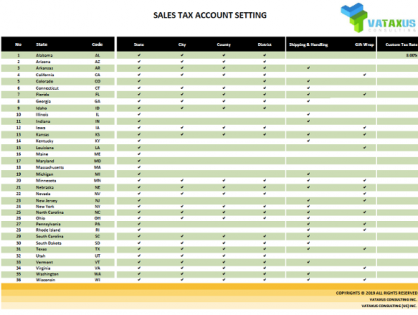

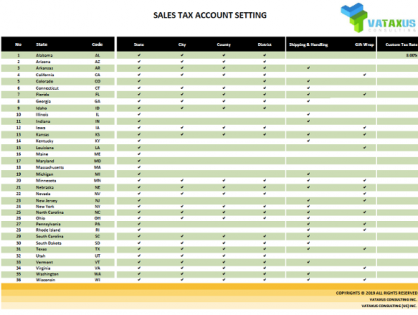

Learn more about Sales Tax Accounting Setting for US states.

Learn more about Sales Tax Accounting Setting for US states.

There are times when the client may require the seller to collect tax to reduce their filing use tax requirements. Some buyers are government departments and require the seller to provide a registered tax number.

Depending on the laws of each state, there will be differences between products that are taxed and those that are not taxed.

For a variety of reasons, a taxpayer may believe that the IRS penalty is unreasonable. But what grounds of defence would be valid?

When expanding your business internationally, it is important to work with both legal and tax experts to avoid potentially costly mistakes and additional expenses in the future. Before embarking on any business, you should consult with local professionals, such as CPAs and attorneys.

With the increasing number of international independent e-commerce businesses and the expansion of sales, it is inevitable that states will strengthen the regulation of cross-border e-commerce sales tax.