Learn more about taxpayer nexus, constitutional nexus requirements, physical presence standard, and much more.

Learn more about taxpayer nexus, constitutional nexus requirements, physical presence standard, and much more.

Form 5472 can be considered a guide for the IRS to understand the global transactions of domestic and foreign related parties, and the penalty for failing to file Form 5472 on time is up to $25,000.

A resale certificate is a signed document indicating that the purchaser intends to resell the goods and is usually provided by the retailer to the wholesaler.

Use tax is defined as a tax on the storage, use or consumption of taxable goods or services on which no sales tax has been paid. Learn more about difference between Sales Tax and Use Tax.

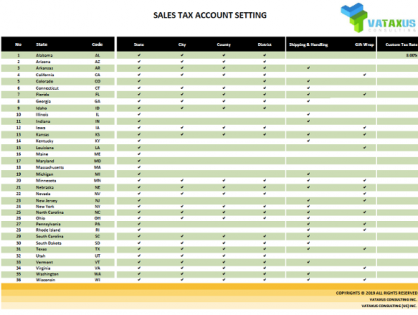

Learn more about Sales Tax Accounting Setting for US states.

Depending on the laws of each state, there will be differences between products that are taxed and those that are not taxed.